tucson sales tax rate 2019

Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

. Please check back soon. If you need to pay your City services bill please follow this link. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

If you wish to contact city staff via phone please call 602-262-6011. The December 2020 total local sales tax rate was also 8700. Tucson is located within Pima County ArizonaWithin Tucson there are around 52 zip codes with the most populous zip code being 85705As far as sales tax goes the zip code with the highest sales tax is 85725 and the zip code with the.

2022 List of Arizona Local Sales Tax Rates. Retail Sales 017 to five percent 50 Communications 005 to five and one-half percent 55 and Utilities 004 to five and one-half percent 55. Wayfair Inc affect Arizona.

2020 rates included for use while preparing your income tax deduction. If you need to access Campaign Finance please follow this link. This is the total of state county and city sales tax rates.

There are a total of 80 local tax jurisdictions across the state. Tucson AZ Sales Tax Rate. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation.

The Arizona sales tax rate is currently. State Local Option. The latest sales tax rates for cities in Arizona AZ state.

Total sales tax 61. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. This includes the rates on the state county city and special levels.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Did South Dakota v.

Sales of products directly to the US. 2019 ARIZONA SALES TAX RATES as of 1212019 Cities iude the Countyncl Tax rate. Effective July 01 2009 the per room per night surcharge will be 2.

Or do I leave the city tax out. Groceries and prescription drugs are exempt from the Arizona sales tax. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower.

This rate includes any state county city and local sales taxes. If you need to pay a parking ticket please follow this link. I feel like a n00b asking this but I have a business located in Flowing Wells area.

2020 rates included for use while preparing your income tax deduction. 36 SIERRA VISTA 245 GILA BEND. This would bring the sales tax total to 81.

The average cumulative sales tax rate in Tucson Arizona is 801. Not being located in the city of Tucson do I include the 2 sales tax for the city of Tucson. Rates include state county and city taxes.

The minimum combined 2022 sales tax rate for Tucson Arizona is. The Tucson sales tax rate is. Of Tucson Business Privilege Sales Tax on retail sales.

Effective July 01 2003 the tax rate increased to 600. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement.

As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817.

The Arizona AZ state sales tax rate is currently 56. 1 TPT News and Updates Newsletters which is placed on the website social media and GovDelivery every 20th or so of the. Sales Tax Increase Effective October 1 2019 Methods of Notification.

Phoenixgov is currently undergoing maintenance. You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. Arizona has 511 special sales tax jurisdictions with local sales taxes in.

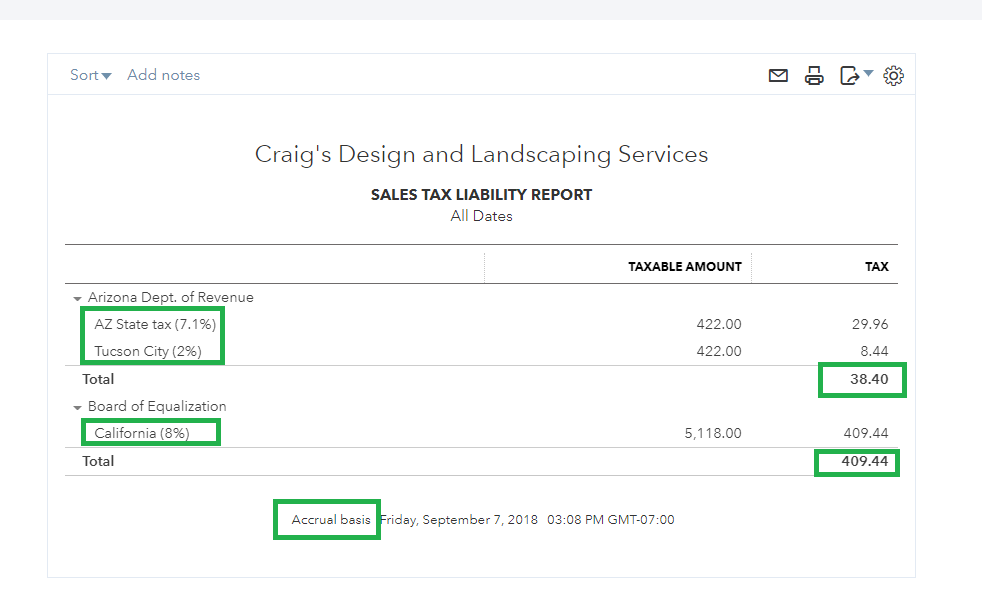

DOUGLAS 43 EL MIRAGE. Yuma AZ Sales Tax Rate. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax.

19-01 to increase the following tax rates. Unlisted cities use county r ate for local sales tax. Avalara provides supported pre-built integration.

This information is based on the City of Tucson Business Privilege Tax Code in effect on July 1 2008. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest.

The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. Taxable at one half the regular tax rate. Tempe Junction AZ Sales Tax Rate.

Depending on local municipalities the total tax rate can be as high as 112. 31 BISBEE 4 CHANDLER. The latest sales tax rate for Tucson AZ.

Aloha and welcome to rOahu a place for anything local like news pics sports events or just stop by talk. Updated Jul 22 2019. The County sales tax rate is.

Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. Sales tax is a tax paid to a governing body state or local for the sale of certain goods and services. First enacted in the United States in 1921 sales tax dates back to ancient Egyptian times where.

The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the model tax code. 103k members in the Oahu community.

Average Sales Tax With Local. This page lists the various sales use tax rates effective throughout Utah. Groceries are exempt from the Tucson and Arizona state sales taxes.

A 1500 refrigerator purchased in Marana where the sales. 24 FOUNTAIN HILLS. The 2018 United States Supreme Court decision in South Dakota v.

Im finding conflicting information. Changes Effective October 1 2019 City of South Tucson. Tucson Sales Tax Rates for 2022.

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

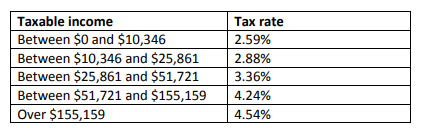

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Sales Tax Rates By City County 2022

State And Local Taxes In Arizona Lexology

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

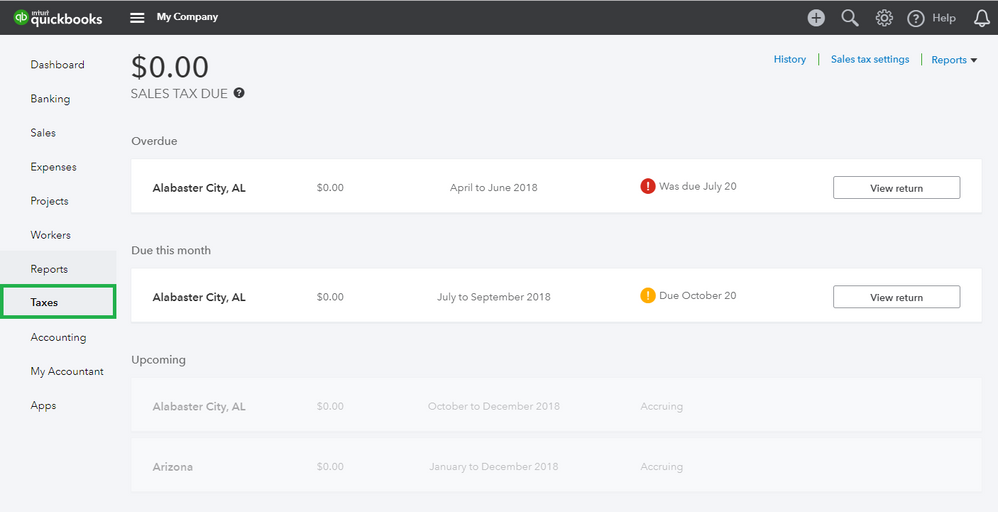

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Property Taxes In Arizona Lexology

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Sales Tax Guide And Calculator 2022 Taxjar

State And Local Taxes In Arizona Lexology

How To Calculate Sales Tax For Your Online Store

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online